Innovative Industrial Properties (IIPR) may be worth considering. With an impressive 8% yield and an outstanding 1,100% growth rate, IIPR has captured the attention of many investors. But is IIPR truly a good dividend stock? Let’s take a closer look.

In today’s volatile market, finding a reliable dividend stock can provide stability and passive income for investors. IIPR Stock, a real estate investment trust (REIT) specializing in the cannabis industry, offers investors the opportunity to capitalize on the growing trend of legalized cannabis. With a unique business model and strong financial performance, IIPR Stock has garnered attention as a top dividend stock in the industry.

Is IIPR a Good Dividend Stock?

When evaluating the suitability of IIPR as a dividend stock, it’s essential to consider key factors such as the company’s dividend yield, dividend growth potential, and overall financial health.

Dividend Yield

One of the most attractive features of IIPR is its impressive 8% dividend yield. This means that for every dollar you invest in IIPR, you can expect to receive 8 cents in dividend payments annually. Compared to the average S&P 500 dividend yield of around 2%, IIPR’s dividend yield is significantly higher, making it an attractive option for income-seeking investors.

Dividend Growth Potential

In addition to its substantial current yield, IIPR has also demonstrated strong dividend growth potential. Since its inception in 2016, IIPR has increased its dividend payout consistently, reflecting the company’s robust financial performance and commitment to rewarding shareholders. With a track record of delivering dividend growth, IIPR has the potential to continue increasing its dividend payout in the future.

Financial Health

Another crucial factor to consider when evaluating IIPR as a dividend stock is the company’s overall financial health. IIPR boasts a strong balance sheet, with healthy cash reserves and minimal debt. This financial stability provides a solid foundation for sustaining and growing its dividend payments, giving investors confidence in the company’s ability to weather economic downturns and market fluctuations.

Long-Term Outlook for Innovative Industrial Properties:

Innovative Industrial Properties (IIP) is a real estate investment trust (REIT) that focuses on the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities. With the growing acceptance of medical and recreational cannabis across the United States, IIP has seen significant growth in recent years. But what can investors expect in the long term?

Factors Influencing Stock Price Predictions:

Regulatory Environment: One of the key factors that can impact the stock price of IIP is the regulatory environment surrounding cannabis legalization. As more states legalize medical and recreational cannabis, the demand for industrial properties leased by IIP is likely to increase, driving up the stock price.

Financial Performance: Another important consideration for predicting the stock price of IIP is its financial performance. Investors will look at metrics such as revenue growth, earnings per share, and dividends to gauge the company’s profitability and stability, which can influence the stock price.

Market Trends: Keeping an eye on market trends in the cannabis industry as a whole can also provide insights into the future stock price of IIP. Factors such as consumer demand, pricing trends, and competition can all impact the company’s performance and stock price.

Why is IIPR Stock Trading Higher?

What sets IIPR apart from other stocks in the market?

One of the main reasons why IIPR stock is trading higher is the company’s unique business model. As a real estate investment trust (REIT) specializing in the marijuana industry, IIPR has positioned itself as a key player in a rapidly growing market. With the legalization of cannabis in many states across the US, the demand for properties to grow and distribute marijuana has skyrocketed, and IIPR has capitalized on this trend.

What are the benefits of investing in IIPR stock?

Investing in IIPR stock offers investors the opportunity to profit from the growth of the marijuana industry without directly investing in cannabis companies. With a steady stream of rental income coming in, IIPR is able to provide investors with consistent dividends while also benefiting from capital appreciation as the stock price continues to rise.

Key Takeaways :

- IIPR stock is trading higher due to its unique business model and positioning in the growing marijuana industry.

- Investing in IIPR offers the opportunity for steady dividends and capital appreciation.

- IIPR’s success highlights the potential for innovative companies to thrive in the market.

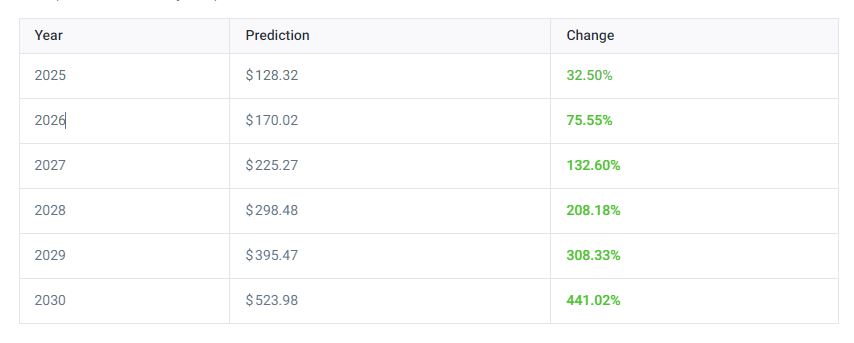

IIPR stock price prediction for 2030

Expert Opinion on Stock Price Predictions:

So, what can investors expect in terms of long-term stock price predictions for Innovative Industrial Properties? While past performance is not indicative of future results, many experts believe that the continued expansion of the legal cannabis market in the US bodes well for IIP. With a strong track record of acquisitions and successful leasing agreements, the company is positioned for growth in the coming years.